Insurance is necessary to protect ourselves against the cost of extensive damage to our home and property, but it can be a double-edged sword.

The first step when you have roof damage is to understand your insurance coverage and whether it’s worth the hassle of a claim.

Insurance for Roof Replacement

Insurance will pay for a roof replacement under certain conditions, such as those caused by a natural disaster and sudden or accidental damage. Let’s break it down:

- Natural disasters: Most homeowners’ insurance will cover damage caused by hurricanes, hailstorms, tornadoes, and severe windstorms, but every policy is different, so it is important to know what your policy covers specifically.

- Accidental damage: Insurance should cover repair or replacement if a vehicle’s impact damages your home. But falling trees are tricky, and they often will not cover tree damage. It depends on the circumstances.

When Insurance Won’t Pay for Damages

- Regular wear and tear: Over time, your roof deteriorates from weather exposure. This damage is not covered by insurance.

- Lack of maintenance: If it shows that your roof hasn’t been maintained properly with regular inspections, cleaning, and simple repairs, there is a good chance your insurance company will deny any claims.

- Policy exclusions: Every insurance company and policy is different. Often, policies have exclusions that prevent coverage under certain circumstances. Know what they are.

Insurance for Roof Replacement: The Procedure

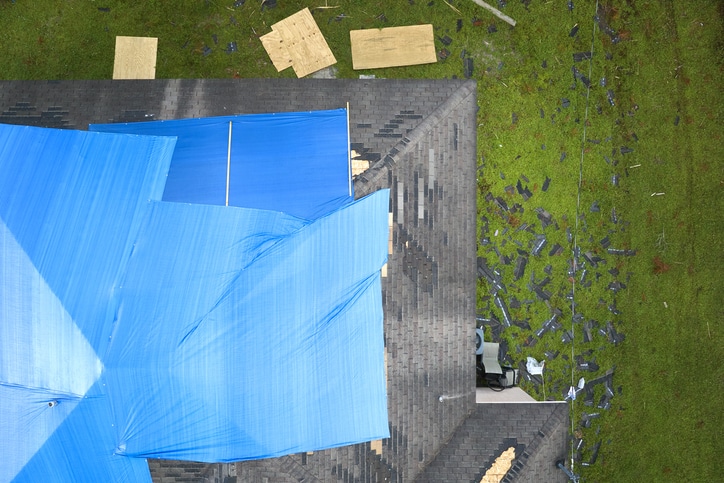

Filing a claim is labor-intensive and possibly complicated. Start by documenting the damage with pictures from many points of view. This gives the insurance adjuster an accurate accounting of the damage.

Once you have pictures, contact your insurance company to complete a detailed report on the incident and how it happened.

The next step is to schedule the insurance adjuster to assess the damage and determine its cause. Based on what the adjuster finds, you will receive an estimate of the cost to repair or replace your roof.

If you are not happy with the amount of damages, now is the time to negotiate a settlement. Often, an attorney may be necessary during these negotiations.

The most frustrating part of the process is the timeframe. Depending on the extent of the damage, complexity, and the efficiency of your insurance company, it could take a while.

A general timeframe for straightforward claims is a few weeks, and for complex claims, several months.

Just because you have insurance doesn’t mean roof damage will be covered, and even if it is, depending on your deductible, you will still have out-of-pocket expenses you may not have planned for.

What happens when insurance for roof replacement is denied, or you have a high deductible?

A company like Southern National Roofing understands the frustration and difficulty of paying for a roof replacement because of damage you didn’t count on. We offer:

- 0% Financing

- $2,500 off roof replacement

- $0 down- no interest, no payment for 12 months

All this with you in mind! We’re here to help you navigate the process.